New in Australia and sorting your first student bank account? This guide shows what to open, how to open it fast, and which features actually help in week one—PayID, instant cards, daily limits, and fee settings. You’ll get a clean step-by-step, a comparison table for major banks, and simple “what to bring” lists.

We’ll also cover debit vs credit, common hiccups (address proof, name order), and safe ways to receive money from home. Want personal help? Book a free call—PickMyUni will match you to the bank account for students that fits your course city and habits.

Why setting up banking early matters

You’ll need local banking for rent, Opal/Myki top-ups, and uni payments.

Faster ID checks = faster SIM, accommodation, and refunds.

Quick win from our calls: setting up PayID on day one saves back-and-forth with flatmates.

Also Read: How to Get an International Student Card in Australia (And Why You Should)

What counts as a “student bank account” in Australia

An everyday transaction account with low/no monthly fees for students, usually paired with a debit card.

Mobile app features to look for: PayID, card lock, BPAY, and international transfer rails.

We’ll also touch on the best student bank account, best student bank account australia, and bank account for students so you can compare options confidently.

Take Your Next Step

Get personalized guidance to make informed decisions about your education journey

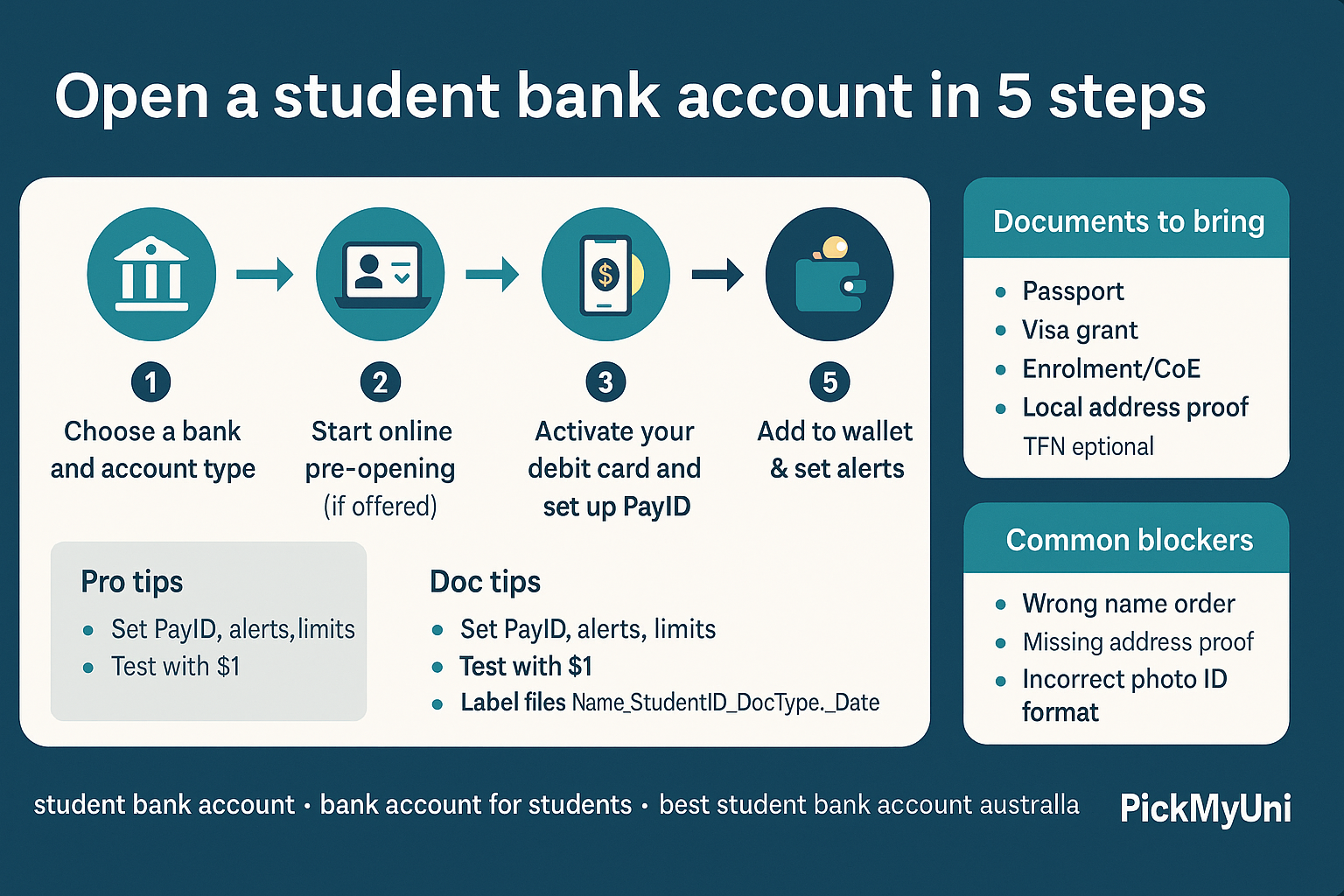

Steps to Open a Bank Account in Australia

Choose a bank and account type.

Start online pre-opening (if offered).

Bring ID to a branch or complete digital verification.

Activate your debit card and set up PayID.

Add to Apple/Google Wallet; set alerts and daily limits.

Popular Australian Bank Options Comparison

Bank & product | Who it suits | Apply path | Typical features to check | International money options | Notes |

Commonwealth Bank student account / commonwealth bank australia student account | Big branch network; new arrivals who want in-person support | Online + branch ID or fully digital | PayID, app card controls, savings spaces | Partnered remittance, FX in-app | Pair with student-labelled debit; see commonwealth bank student credit card info below |

ANZ bank student account | Simple app, easy PayID setup | Online pre-open + branch ID | No/low monthly fee, BPAY, wallet integration | FX options; check overseas transfer limits | Credit review rules apply for anz bank student credit card |

Other majors & regionals | Students near certain campuses/suburbs | Mix of digital + branch | Shared accounts for flatmates, fee waivers | Transfer partners vary | Compare ATM access near your housing |

Documents Required to Open a Bank Account in Australia

Passport, visa grant notice, student ID/enrolment letter, local address proof (if required).

TFN (optional but helps with interest tax settings).

Label files as Name_StudentID_DocType_Date to speed staff checks.

Bank Account Features that actually help students

PayID for instant splits with housemates.

Daily limits & alerts to stay on budget.

Card lock/replace in-app if lost.

Spaces/vaults to separate rent, food, and travel.

Student income bank habits: tag income from casual shifts or transfers so you can prove funds later.

Debit vs credit (go slow and read conditions)

Debit = everyday spending from your own funds.

Credit = stricter checks; useful for bond or travel bookings if eligible.

Examples to research once you’ve opened a transaction account: commonwealth bank student credit card, and bank student credit card. Eligibility and costs vary—read each bank’s product page carefully.

Bank Opening Timings For International Students

Pre-open from overseas where allowed; finish ID after landing.

If pre-open isn’t possible, book a branch slot in your first 48 hours.

First transactions to test: wallet tap, a PayID transfer, and a small international deposit.

Things to Consider before Opening a Bank Account

Monthly fee status and any student waiver.

ATM network near campus/home.

FX margins and international transfer fees.

Card replacement and overseas ATM usage.

Turn on app notifications and geoblocking as needed.

Getting paid and sending money home via an Australian Bank

Share PayID or BSB/account to employers and roommates.

For overseas transfers: compare in-bank vs external remittance; test with a small amount first.

Keep records for visa or tenancy proof.

Security basics (simple but important)

Strong passcodes; don’t share one device login; lock the card if lost.

Be cautious with “urgent” payment requests—verify by phone.

Use bank-approved channels for support.

Common mistakes & quick fixes

Only carrying a passport → bring enrolment and address proof too.

Forgetting PayID → set it up to avoid wrong BSB/account typos.

Using random remitters → start with a small transfer and keep the receipt.

Ignoring alerts → turn on spend notifications and overseas transaction controls.